Sustainable and responsible investing Profitable and Green Investing in 2024

12.04.2024 • 12 Reading Time

Contents

The most important facts at a glance:

- As an investor, you can use your capital to promote the expansion of economic, social and environmental sustainability with sustainable investments.

- The more the economy and policymakers are committed to more sustainable measures, the larger, more diverse and lower-risk the range of sustainable investment products will be.

- Since the term “sustainability” is not protected, many companies find it easy to use greenwashing methods to give their investment products a green coat of paint (greenwashing).

- With impact funds, you invest in an investment product that makes its sustainable impact transparent and measurable. Investors thus benefit from being transparently informed about the impact of their investment capital.

- By investing in sustainable investments, you not only actively promote a positive impact, but also take advantage of the opportunities of future-oriented growth markets at an early stage, for example in the area of renewable energy.

The demand for sustainable alternatives is growing - and so is the supply. Sustainability is experiencing strong growth in almost all sectors of the economy - including the area of investments. Investors are very open to sustainable investments: according to a study, 38% of respondents would like to invest sustainably, even if it meant lower returns.¹ However, it has already been proven that sustainable investments are not associated with lower expected returns - on the contrary, they are often accompanied by attractive growth opportunities.

Figures on invested capital also clearly show how the popularity of sustainable investments is increasing: In Germany, the volume of sustainable investments rose by 15% to €578.1 billion between 2018 and 2022.²

Politicians are also supporting sustainable business. In 2017, the German government invested over 17 billion euros in sustainability research projects. In addition, the EU promotes sustainable growth and is committed to transparent and sustainable business practices with measures such as the introduction of the EU Taxonomy and the EU Disclosure Regulation.

Institutional investors are also increasingly focusing on sustainability: in 2022, the institutional investment volume for sustainable investments amounted to EUR 102.2 billion. ESG criteria (environmental, social and governance aspects) are crucial here. Prominent figures from the financial world such as Larry Fink from Blackrock also recognize the risks associated with conventional economic methods and recommend sustainable investments as a viable, long-term alternative.

What are sustainable investments?

With a sustainable investment, you invest your capital in financial products such as shares, investment funds or bonds - just like with conventional investments. The special feature is that the selected investment products are sustainable. For example, you can invest in shares in sustainable companies or invest capital in a sustainable real estate fund.

The so-called ESG criteria can help you to better assess sustainability in the world of investments. This involves sustainability in three different dimensions: Environmental (Environmental), Social (Social) and Governance (Governance). For example, if an investment fund invests in renewable energies such as wind power or solar parks, the focus is on environmental sustainability.

Other investments, for example, invest in companies that are committed to respecting human rights and fair supply chains - the focus here is on social sustainability. If, for example, investments are made in shares of companies that place particular emphasis on fair and transparent corporate governance, the focus is primarily on economic sustainability.

Many sustainable investments are also geared towards the 17 UN Sustainable Development Goals (SDGs). These goals were adopted as part of the 2030 Agenda. They include, for example, better educational opportunities, access to healthcare systems, fair working conditions and climate protection. Here, too, various dimensions of sustainability are addressed.

ESG criteria

Sustainable investments: demand is rising

The demand for sustainable alternatives is growing - and so is the supply. Sustainability is experiencing strong growth in almost all sectors of the economy - including the area of investments. Investors are very open to sustainable investments: according to a study, 38% of respondents would like to invest sustainably, even if it meant lower returns.¹ However, it has already been proven that sustainable investments are not associated with lower expected returns - on the contrary, they are often accompanied by attractive growth opportunities.

Figures on invested capital also clearly show how the popularity of sustainable investments is increasing: In Germany, the volume of sustainable investments rose by 15% to €578.1 billion between 2018 and 2022.²

Politicians are also supporting sustainable business. In 2017, the German government invested over 17 billion euros in sustainability research projects. In addition, the EU promotes sustainable growth and is committed to transparent and sustainable business practices with measures such as the introduction of the EU Taxonomy and the EU Disclosure Regulation.

Institutional investors are also increasingly focusing on sustainability: in 2022, the institutional investment volume for sustainable investments amounted to EUR 102.2 billion. ESG criteria (environmental, social and governance aspects) are crucial here. Prominent figures from the financial world such as Larry Fink from Blackrock also recognize the risks associated with conventional economic methods and recommend sustainable investments as a viable, long-term alternative.

"With increasing democratization and regulatory openness, private investors will also be able to benefit more intensively from infrastructure investments - at the same time, essential capital for the energy transition will be mobilized."

Can anyone invest sustainably?

How to identify sustainable investments

Terms such as "sustainable", "green", "social", "ecological" and "impact" are still often used without a fixed definition for investments. The spectrum of sustainable investments includes a whole range of investment philosophies, instruments and methods. This makes it all the more important to know the basic investment strategies and be able to differentiate between them.

The ESG approach has emerged as the standard. As already shown, this approach looks at environmental, social and governance aspects. These include, for example, energy consumption, waste production, compliance with human rights in the supply chain and corruption prevention. Depending on the method, this information is requested and included in the screening process.

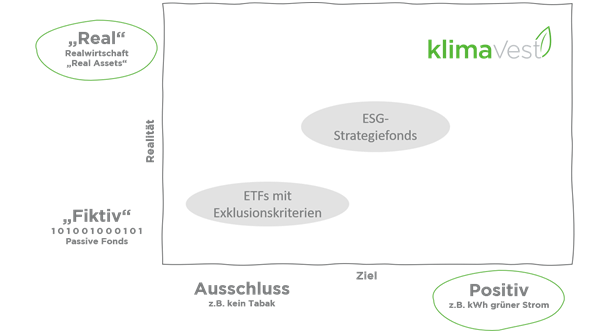

Investment approaches that apply exclusion criteria form one side of the sustainability spectrum. They represent the largest volume to date. At the other end of the spectrum are impact investments, which aim to achieve a measurable positive ecological or social impact in addition to returns. They relate most strongly to the real economy.

Exclusion criteria

Weapons, nuclear power, genetic engineering, gambling or tobacco: investors do not want to fund certain controversial industries. These companies cannot even get into a portfolio thanks to negative screening. This sustainability requirement is relatively low, as sustainable activities are not explicitly promoted. However, it nevertheless excludes some non-sustainable companies and countries.

Positive criteria

Environmental management, social standards, efficiency technologies: in positive screening, companies, countries, sectors and projects are examined for certain positive ESG aspects and included in the portfolio accordingly.

Best-in-class approach

The greenest car manufacturer, the food company that treats employees well, the chemicals group with the most intensive sustainability research: the best-in-class approach makes the (listed) best-in-class equities of each industry visible, even if the sector itself is not necessarily sustainable.

Norms-based approach

Forced labour, child labour, corruption or the death penalty: in norms-based screening, investments are checked for compliance with international standards. These include guidelines issued by the OECD, UNICEF, ILO and the United Nations.

ESG integration

Explicit ESG investments systematically integrate environmental and social factors as well as aspects of sustainable investment decisions. Among other things, the investment managers aim to minimise sustainability risks for their investments.

Thematic funds

Renewable energy, organic agriculture, education: sustainable thematic funds are part of sustainable investment funds and set specific priorities in the selection of companies, above all via sectors. These include, for example, environmental funds for renewable resources such as wood and water, renewable energy funds and green real estate. Solar funds or wind power funds are also included in such thematic funds.

Impact investing

Concrete, targeted and measurable: impact investing combines returns on investment with environmental and social impact. The capital supports concrete sustainability projects that solve a social problem, e.g. in the area of poverty alleviation, renewable energies, green technologies, agriculture or forestation.

It is difficult to assess what is truly sustainable. There are now separate rating and research agencies that assess companies, financial products and countries using sustainability criteria in accordance with the ESG approach. The resulting sustainability ratings are a helpful tool for investors and fund managers to analyse securities and compile portfolios.

Whether an investment described as “green”, “ethical” or “ESG” actually has a sustainable impact is not always guaranteed. Greenwashing describes an activity in which companies sell products claiming them to be more sustainable than they actually are.

Questions that help with the review include:

-

Objectives: What does the investment do for sustainability?

-

Effect: Does the money flow into the real economy or does it only circulate within the financial economy?

-

Transparency: How is sustainability measured and what is reported?

Sustainable and responsible investing: these are the options open to investors

Bank accounts

Banks lend their savers’ money in the form of loans to companies and institutions. It is therefore worth taking a general look at a bank’s sustainability activities in order to gain an impression of their lending practices.

Equities

Acquiring shares in listed companies only supports their business operations in an indirect way. Companies cannot invest the money directly in sustainable innovations because the money usually only goes to the previous owner at the time the shares are purchased.

However, a higher stock market price increases the value of the company, which makes it easier for it to obtain loans from banks, for example, and thus finance sustainability projects. Whether it does so or whether it invests in other, less sustainable areas, is something that retail investors cannot influence.

Bonds / green bonds

In the case of bonds and green bonds (pension funds), investors’ money flows into loans to countries or companies, so-called government bonds or corporate bonds. Linked to ESG criteria, they exclude certain industries and practices, for example companies that promote fossil energy or countries that do not observe the rule of law. Some bonds apply positive criteria and invest, for example, in forests, wind power or efficiency technologies.

ESG funds

More sustainable alternatives are now available for all categories of funds. They can often be identified by various term prefixes, e.g. SRI (Socially Responsible Investing), ESG (Environment, Social, Governance), fair value, responsible, eco, ethical or impact (impact-oriented investing).

Sustainable index funds (ETFs) track an index in which certain sectors such as weapons or alcohol are excluded ("ex") or companies are selected as the best-in-class in their sector. They are therefore also referred to as passive funds.

Although actively managed funds are more expensive because the selection of companies by experts and analysts is more complex, these investment funds often pursue a higher sustainability requirement, as they can select each security individually according to certain criteria, which is generally also communicated to investors.

Sustainable ETFs

Thematic funds

Renewable energy, organic agriculture, education: sustainable thematic funds are part of sustainable investment funds and set specific priorities in the selection of companies, above all via sectors. These include, for example, environmental funds for renewable resources such as wood and water, renewable energy funds and green real estate. Solar funds or wind power funds are also included in such thematic funds.

Crowdinvesting

Start-ups and projects like to gather money from a large number of people – the “crowd” – in what is known as crowdinvesting. Whether it’s a cultural project, ecological garden equipment or electric moped, many good ideas need the combination of financing and a fan base for a successful start.

Investors become co-owners or lenders, often in the form of relatively risky subordinated loans. Therefore, you should take a very close look at these projects and not invest if you consider yourself to be more safety-oriented.

Real estate funds with a focus on sustainability

Investing in sustainable start-ups

Impact funds

Impact investing stands for impact-oriented investment and combines the goal of financial returns with measurable sustainability performance. Impact funds, as a relevant financial instrument, formulate specific sustainability goals that are to be achieved with the help of certain measures. The focus here is on transparency and measurability.

Impact funds enable investors to fund social enterprises, enable microloans in emerging and developing countries or devote themselves to the expansion of renewable energy in a measurable way.

The main difference between impact investing and investing in equities or other securities funds is that investors’ money flows into the real economy and does not run the risk of circulating only in the financial economy.

In particular, with investments in future-oriented growth markets, such as renewable energy, impact funds also offer attractive potential returns in addition to their demonstrably sustainable impact.

INVEST IN INFINITY

Invest in the full potential of unlimited resources - with klimaVest, the fund for renewable energy.

Find out more

7 myths about sustainable investments

Myth #1: You have to give up returns with sustainable investments

This is not true. The returns on sustainable investments are on average equal to or slightly better than the returns on conventional investments. Scientific findings on this are one of the reasons why more and more investors are interested in sustainability⁷.

And the emergence of future-oriented growth markets, for example in the field of renewable energies, is also helping to positively influence the return expectations of sustainable investments. This is because renewable energies are gaining in popularity as demand increases and therefore also offer promising investment opportunities for investors.

Myth #2: You can't measure sustainable impact

Measuring sustainable impact is complex and involves uncertainties. However, analytical tools are being developed and constantly improved. Rating agencies use ESG (environment, social, governance) criteria to assess the sustainability performance of companies.

Myth #3: You have to be an expert to understand sustainability

Less than you might think, because: Individual investors know best what is important to them when investing capital. This can be found out using checklists* and discussions with customer advisors, who will also have to address sustainability in the future.

Myth #4: There is no such thing as a 100% sustainable investment

True. As in nature and in society, everything in the economy is connected. Where do a company's raw materials, financial resources and labor come from - do they have an environmentally or socially "difficult" past? Even the most sustainable product cannot reach the customer completely emission-free. Sustainable development is a process, but it can be accelerated with sustainable investments. In view of the global challenges, the following applies: "Never mind if it's quick". Every euro counts.

Myth #5: Sustainable investments only affect the environment

The assumption that sustainability is only associated with protecting the environment and the climate is long outdated. Social and economic/corporate sustainability are now just as important, as the ESG criteria make clear. Environmental sustainability can only be achieved in the long term if sustainable values are also more firmly anchored in business and society. It is therefore important to take a holistic view of sustainability - and to promote it holistically.

Myth #6: Sustainable investments are only for idealists

Some people believe that sustainable investments are only for those who are already interested in and committed to environmental or social issues. In reality, however, sustainable investments are suitable for all investors who want to take long-term risks and opportunities into account. Sustainable investing primarily means investing for the long term and with an eye to the future. This means that sustainable investing is not just something for people with a particular focus on sustainability, but is also increasingly being taken into account in professional portfolios.

Myth #7: Sustainable investments lack diversification

Another myth is that sustainable investment funds are not sufficiently diversified as they exclude entire sectors or companies. In fact, there is a broad and growing range of sustainable companies in almost every sector that are suitable for investment.

The range of sustainable investments and companies that are suitable for sustainable investments is therefore constantly growing - and ensures a high degree of diversification.

FAQs about sustainable investments

What is a sustainable investment?

What sustainable investments are available?

However, investments that are described as sustainable are not always really sustainable - recognized seals of approval and certificates can help to distinguish genuinely green financial products from greenwashing products.

Why invest sustainably?

How can i identify a sustainable fonds?

As part of the EU Disclosure Regulation, financial products are now also obliged to publish their own reports on the fund's performance.

When is a fund or investment sustainable?

However, as there is no universal definition of sustainability, the interpretation of this is left to the individual providers. What matters here is transparent reporting so that investors can inform themselves about the sustainability of the investment and the individual assets.

² BaFin (2019): How safe is sustainable? www.bafin.de/SharedDocs/Veroeffentlichungen/DE/Fachartikel/2019/fa_bj_1906_nachhaltige_Geldanlage.html

³ Sustainable Investment Forum (FNG); Market Report 2020. https://www.forum-ng.org/fileadmin/Marktbericht/2022/FNG-Marktbericht_NG_2022-online.pdf

⁴ Global Sustainable Investment Review 2018 www.gsi-alliance.org/wp-content/uploads/2019/06/GSIR_Review2018F.pdf

⁵ www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

⁶ www.forum-ng.org/de/nachhaltige-geldanlagen/nachhaltige-geldanlagen.html

⁷ see, for example, the meta study: Gunnar F., Busch T. ; Bassen, A. (2015): “ESG and financial performance: aggregated evidence from more than 2000 empirical studies”. In: Journal of Sustainable Finance & Investment 5.4, pp. 210-233.

Pinner, W. (2019). Investing sustainably: specific topics and their evaluation. Vienna: Linde International.

⁸ CSR News (2016): Study: Investoren sollten CO2-Emissionen von Unternehmen berücksichtigen [broadly translated from German as: Investors should consider corporate CO2 emissions] www.csr-news.net/news/2016/06/12/studie-investoren-sollten-co2-emissionen-von Unternehmen-berücksichtigen/